International Tax Consultant in Delhi – Your Trusted Partner for Global & Domestic Tax Compliance

In todays interconnected global economy, managing international and domestic tax obligations can be a daunting task for individuals and businesses alike. Whether you're a multinational enterprise, an NRI with assets in India, or a local business navigating complex tax laws, hiring a professionalInternational Tax Consultant in Delhican simplify your tax strategy and ensure full legal compliance.

AtLegal & Tax Consultant India, we specialize in offering expert advice and end-to-end solutions fortax compliance in Delhi,India, and globally. With decades of experience in international and NRI taxation, we have earned a reputation for integrity, accuracy, and client satisfaction.

Why You Need an International Tax Consultant in Delhi

International taxation involves understanding double taxation treaties (DTAA), transfer pricing rules, expatriate tax compliance, and cross-border income reporting. Its not just about filing returns its about optimizing your global tax liability while staying compliant with Indian and international tax laws.

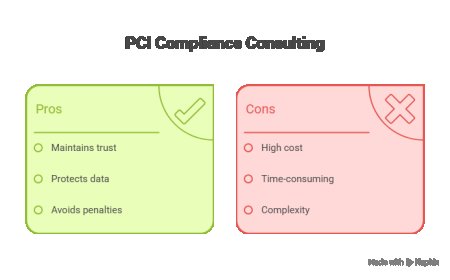

Heres why working with a certifiedconsultant for tax compliance in Delhiis essential:

- Compliance with Changing Regulations:Tax laws in India and abroad are continuously evolving. We stay updated with every amendment in Indian Income Tax, FEMA, and global tax treaties.

- Avoid Penalties:Non-compliance can lead to hefty fines, interest charges, or even legal actions.

- Strategic Tax Planning:A good tax consultant doesnt just file your return they help you plan it. Strategic planning can save you thousands in taxes.

- Handling Complexities for NRIs & Expats:Cross-border investments, property sale, repatriation of funds, or income from multiple countries? Weve got you covered.

Our Core Services

As a top-ratedconsultant for Tax Compliance in India, our services are tailored to meet the unique tax needs of individuals, NRIs, expats, and corporate entities.

1. International Taxation Services

- DTAA advisory (Double Taxation Avoidance Agreements)

- Expatriate tax planning

- Cross-border tax structuring

- Transfer pricing compliance and documentation

- Global income reporting

Our specializedInternational Tax Consultant in Delhiensures that your foreign and domestic income is taxed correctly under the appropriate treaties and laws.

2. NRI Taxation & Compliance Services

As an experiencedConsultant for NRI Taxation in Delhi, we assist Non-Resident Indians in:

- Filing income tax returns in India

- Capital gains on sale of property

- Repatriation of funds abroad

- TDS refunds and lower deduction certificates

- Compliance under FEMA and RBI regulations

If you're an NRI with property, business, or bank accounts in India, our team ensures yourtax compliance in Indiais smooth and hassle-free.

3. Domestic Tax Compliance

If you're a resident individual, freelancer, or SME owner, we provide comprehensivetax compliance in Delhiincluding:

- Income Tax Return (ITR) filing

- Tax audit support

- GST registration and filing

- PAN/TAN application and correction

- Advance tax planning and investment declarations

Ourconsultant for tax compliance in Delhiworks closely with you to minimize your tax liability while ensuring 100% compliance with Indian tax laws.

Why Choose Us?

At Legal & Tax Consultant India, we combine industry knowledge with personalized attention. Here's what sets us apart as a preferredInternational Tax Consultant in Delhi:

? 20+ Years of Experience

We have handled tax cases for businesses and individuals across India, the US, UK, UAE, Canada, and Australia.

? Client-Centric Approach

Every client is unique. We tailor our tax solutions according to your personal or business profile.

? Transparent Pricing

No hidden fees or surprise bills. We offer upfront pricing and customized service packages.

? Tech-Enabled Support

Digital documentation, e-filing, and cloud-based tracking mean you can manage your taxes from anywhere in the world.

? One-Stop Tax Partner

Whether you're looking for aconsultant for tax compliance in Indiaor need help withNRI taxation, were your single window for all tax services.

Case Study How We Helped an NRI Client Save ?5 Lakhs

One of our recent clients, an NRI based in Dubai, approached us for advice on selling a residential property in Delhi. He was concerned about TDS deductions, repatriation of funds, and income tax filing in India.

OurConsultant for NRI Taxation in Delhi:

- Calculated exact capital gains after indexation

- Helped apply for a Lower TDS Deduction Certificate

- Filed the ITR showing capital gains and paid tax accordingly

- Managed RBI compliance for fund repatriation

End result? Our client legally saved over ?5 lakhs in taxes and completed the property transaction smoothly.

Final Thoughts

Global financial success starts with smart tax planning. With expert guidance from a trustedInternational Tax Consultant in Delhi, you can focus on your business or career while we take care of your compliance and savings.

Contact us today to schedule a consultation your peace of mind is just a call away.

Contact the Best International Tax Consultant in Delhi

If you're looking for a reliableconsultant for tax compliance in Delhior need expert guidance oninternational or NRI taxation, look no further than Legal & Tax Consultant India.

? Visit Us At:

115, Lower Ground Floor, Sector-12A, Dwarka, New Delhi-110078

? Call Us:

+91-9810957163

? Email:

info@legalntaxindia.com

Whether you're in Delhi, abroad, or managing business operations in multiple countries, our team ensures yourtax compliance in Indiais timely, accurate, and stress-free.