Avoiding Common Mistakes with Expert PCI Compliance Consulting.

Ensure your business meets PCI compliance standards with expert consulting. Avoid common pitfalls and protect your customers' data effectively.

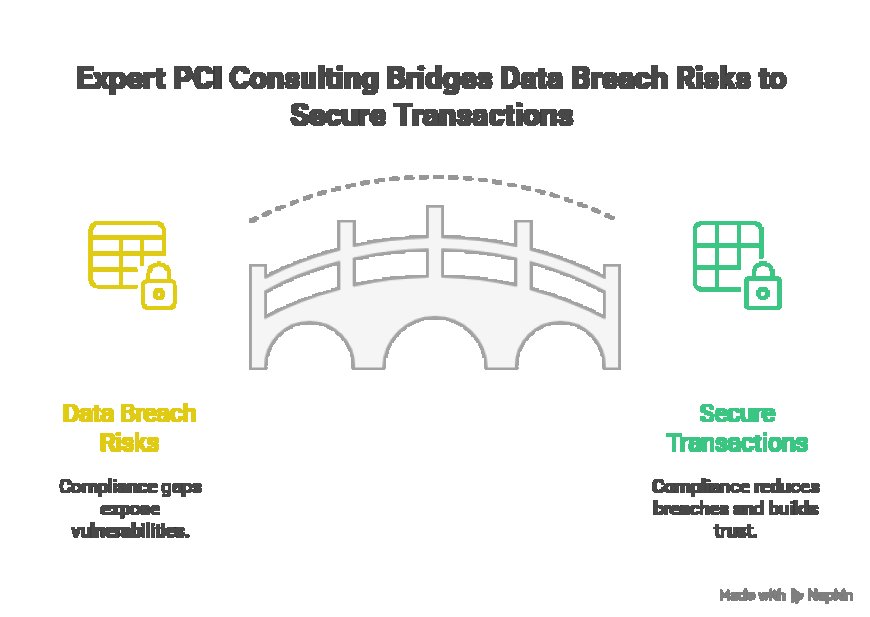

In todays digital world, data breaches are a major concern for businesses of all sizes. If your company handles customer payment information, PCI (Payment Card Industry) compliance isn't optionalit's a critical requirement. However, many businesses unknowingly make serious mistakes when trying to manage compliance internally. Thats whereexpert PCI Compliance Consulting makes a difference.

Lets explore the most common PCI compliance mistakes and how expert consultants can help you avoid them while improving your overall network security solutions and cybersecurity compliance posture.

1. Underestimating the Complexity of PCI Requirements

Many business owners think that PCI DSS (Data Security Standard) is a simple checklist. In reality, its a complex framework that demands in-depth knowledge of data protection, network infrastructure, and access control.

PCI Compliance Consulting experts understand these requirements inside and out. They ensure that every aspect of your IT environmentfrom firewalls to user accessis fully compliant.

2. Relying on Outdated Technology

Old systems and insecure networks are some of the biggest threats to payment data security. If you're still using outdated software or unpatched servers, you're at serious risk.

Professional consultants can guide you in integrating modern network security solutions and updating your systems. For businesses with high data loads, they often recommend upgrading to business fiber internet, which supports faster and safer data transmission.

3. Ignoring Physical Security Measures

PCI compliance isnt just about digital systemsit includes physical access control as well. If your servers or payment processing systems can be accessed by unauthorized personnel, youre non-compliant.

Solutions like a Commercial Perimeter Security System and secure server rooms are often recommended by consultants to meet these physical security standards.

4. Failing to Monitor and Test Security Regularly

Compliance is not a one-time event. Many businesses make the mistake of achieving compliance once and then neglecting regular testing and monitoring.

PCI Compliance Consulting services include ongoing risk assessments and penetration testing to ensure your system remains secure. These practices align with broader cybersecurity compliance solutions strategies.

5. Not Aligning PCI Compliance with Other Regulatory Standards

Businesses that operate internationally or store personal data must also follow GDPR, ISO, and other standards. Trying to manage all these requirements separately can lead to overlap, inefficiency, or non-compliance.

Experienced consultants often offer GDPR Compliance Consulting and ISO 27001 Compliance Consulting services alongside PCI, helping streamline your entire regulatory framework under one roof.

Why Choose Professional PCI Compliance Consulting?

Here are just a few advantages:

-

Time & Cost Efficiency Avoid penalties and data breaches that can cost you millions.

-

Improved Security Enhanced protection through updated systems and cybersecurity compliance solutions.

-

Business Continuity Secure infrastructure supported by business fiber internet and robust internal protocols.