Is Your Business PCI Compliant? Why You Shouldn’t Skip Professional Consulting.

Ensure your business is PCI compliant to protect customer data. Discover why professional consulting is essential for compliance and security success.

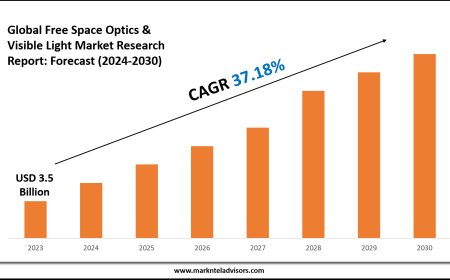

In today's digital world, every business that processes, stores, or transmits credit card data must comply withPCI DSS (Payment Card Industry Data Security Standards). Yet, many companies either delay or overlook this critical responsibilityoften leading to security breaches, legal penalties, and loss of customer trust. This is where professional PCI Compliance Consulting becomes not just helpful, but essential.

What is PCI Compliance and Why Does It Matter?

PCI compliance ensures that your business is securely handling customer card information. Whether you're a retail store, e-commerce business, or service provider, being non-compliant can expose your business to:

-

Heavy fines and penalties

-

Costly lawsuits

-

Loss of merchant account privileges

-

Irreparable brand damage

By working with PCI Compliance Consulting experts, you get access to advanced tools, techniques, and support to meet these complex requirements efficiently.

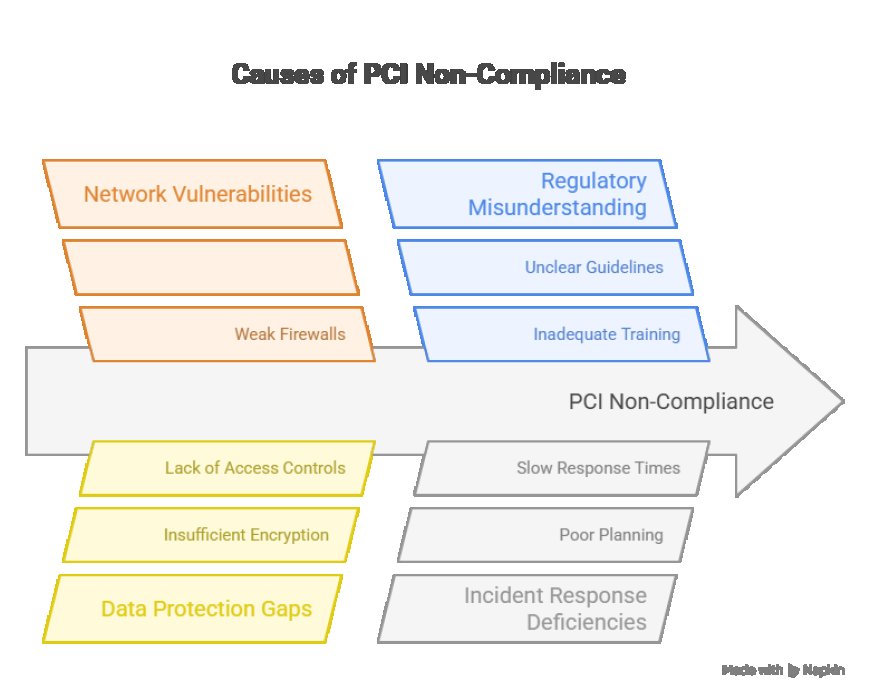

Why DIY Compliance Is Risky

Trying to manage compliance internally often leads to:

-

Misinterpretation of regulations

-

Incomplete implementation

-

Unsecured payment systems

-

Missed deadlines and audits

Professional consultants offer end-to-end supportfrom vulnerability assessments to audit preparation. They also integrate your PCI efforts with broader cybersecurity compliance solutions to protect your business from evolving threats.

How PCI Compliance Fits Into Your Overall Security Framework

Compliance isn't a checkboxit's part of a comprehensive network security solution. Pairing PCI with other key standards like ISO 27001 Compliance Consulting and GDPR Compliance Consulting ensures your systems are holistically protected and legally compliant.

A consulting partner will often evaluate:

-

Firewall and encryption setups

-

Access controls and authentication

-

Security monitoring and incident response

-

Physical security, including Commercial Perimeter Security Systems

They'll also advise on secure connectivity options like business fiber internet, which offers enhanced speed, uptime, and security for handling sensitive payment data.

Top Benefits of Hiring a PCI Compliance Consultant

Heres what you gain when working with a certified compliance expert:

Risk Reduction: Get a clear map of your security gaps and how to fix them

Time Savings: Avoid spending months interpreting regulations and policies

Audit-Readiness: Prepare accurate documentation and reports for auditors

Technology Integration: Align compliance with your current systems and infrastructure

Cost-Efficiency: Prevent data breach costs that could cripple your business

Compliance Isn't OptionalIt's a Competitive Advantage

In an era of rising cyber threats and increasing data regulations, compliance is credibility. Customers trust businesses that show clear commitment to securing their data. Integrating PCI Compliance Consulting with cybersecurity compliance solutions and network security solutions makes your business more resilient and trustworthy.