The Role of PCI Compliance Consulting in Secure Payment Systems.

Discover how PCI compliance consulting enhances secure payment systems, protecting sensitive data and ensuring regulatory adherence for businesses of all sizes.

In todays digital age, secure payment processing is not just a convenienceits a necessity. With cyber threats on the rise, businesses handling credit card transactions must comply with strict data security standards. Thats wherePCI Compliance Consulting comes into play.

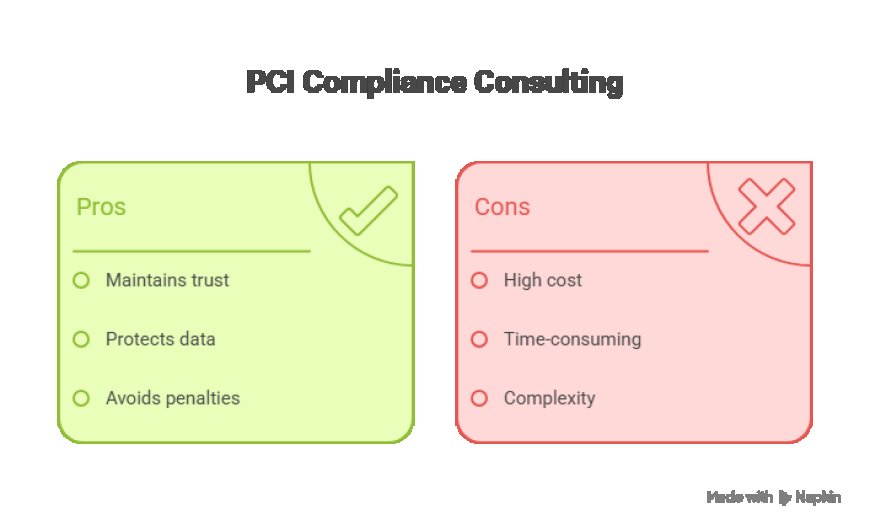

PCI (Payment Card Industry) Compliance ensures that your business follows the necessary protocols to protect cardholder data. But staying compliant can be a complex processespecially for small and medium-sized businesses. This is why working with a PCI Compliance Consulting firm is crucial for maintaining trust, protecting customer data, and avoiding costly penalties.

Why PCI Compliance Matters

PCI Compliance is governed by the PCI DSS (Data Security Standard), a set of security standards developed by major credit card companies to safeguard cardholder information. Failure to comply with these regulations can result in:

-

Hefty fines

-

Loss of customer trust

-

Increased risk of data breaches

-

Suspension of credit card processing privileges

Engaging professional PCI Compliance Consulting services helps businesses navigate the complexities of these standards, ensuring proper implementation and ongoing compliance.

How PCI Compliance Consulting Secures Payment Systems

A qualified consultant will assess your current payment infrastructure and provide solutions to close any security gaps. Here's what they typically offer:

-

Security Risk Assessments

-

Network Security Solutions Implementation

-

Regular Security Audits

-

Staff Training on Compliance Protocols

-

Data Encryption & Secure Storage Guidance

Additionally, consultants help businesses achieve layered protection by integrating Commercial Perimeter Security Systems, firewalls, and cybersecurity compliance solutions tailored to their industry needs.

Beyond PCI: A Holistic Compliance Approach

Modern businesses often need to comply with multiple data protection standards, especially those operating internationally. Leading PCI Compliance Consulting firms also offer:

-

GDPR Compliance Consulting For businesses handling data of European Union citizens

-

ISO 27001 Compliance Consulting For establishing global information security management best practices

These standards, along with PCI DSS, create a robust framework for data protection across all platforms.

The Link Between PCI Compliance and Business Internet Infrastructure

A strong security framework isnt just about softwareit also depends on the stability and speed of your network. Businesses must invest in high-quality connectivity like business fiber internet, which provides faster data transfers and better support for secure transactions.

Pairing reliable business fiber internet with solid network security solutions creates a secure foundation for payment systems to function without interruptions or vulnerabilities.